by Dmitry Butrin, Natalia Grib, and Petr Yozh

Iran's Ayatollah Khamenei Surprises Russia with "Gas OPEC" Proposal

Russia spent last year strenuously denying reports that it was participating in the creation of a cartel of gas suppliers to the EU. Now, however, the idea has received an unexpected boost from Iranian leader Ayatollah Ali Khameni, who called on Russia to create a "gas OPEC" at a recent meeting with Russian Security Council secretary Igor Ivanov. Although a cartel would be unprofitable for Gazprom, an energy union cum geopolitical alliance of Russia, Iran, and Algeria does appear to be in the works.

Iran's Ayatollah Khamenei Surprises Russia with "Gas OPEC" Proposal

Russia spent last year strenuously denying reports that it was participating in the creation of a cartel of gas suppliers to the EU. Now, however, the idea has received an unexpected boost from Iranian leader Ayatollah Ali Khameni, who called on Russia to create a "gas OPEC" at a recent meeting with Russian Security Council secretary Igor Ivanov. Although a cartel would be unprofitable for Gazprom, an energy union cum geopolitical alliance of Russia, Iran, and Algeria does appear to be in the works.

Russian Security Council secretary Igor Ivanov's recent official visit to Tehran was in many ways the flip side of Russian first deputy prime minister Dmitry Medvedev's speech at the World Economic Forum in Davos, where the agenda was focused on the political consequences of the increasing clout wielded by oil- and gas-rich countries in the global economy.

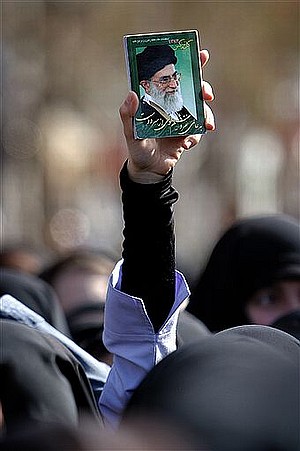

In Switzerland the discussion clearly went nowhere, while during Mr. Ivanov's visit to Tehran, all it took was a few words from Iranian Supreme Leader Ayatollah Ali Khamenei to turn the occasion into a sensation. Commenting on the message sent to him by President Putin and the idea of partnership between Russia and Iran, the ayatollah unexpectedly initiated a discussion of creating a "gas OPEC." "Our two countries, in helping each other, can create an organization based on cooperation in the gas sphere, along the lines of OPEC," the Iranian state news service IRNA quoted Ayatollah Khamenei as saying.

IRNA did not report Mr. Ivanov's answer, and there is a reason for that. The idea of a "gas OPEC" is explicitly Russia's, but Russia consistently denies reports that the Kremlin has plans to create a cartel uniting the countries that supply gas to the EU. The most recent denial of the existence of plans for a "gas OPEC" came during Russian Minister of Industry and Energy Viktor Khristenko's visit to Algiers in January, when Algeria and Russia issued a joint statement saying that they see no point in organizing a gas pricing cartel.

The phrase "gas OPEC" entered the global political lexicon in the wake of a Financial Times article from November 13, 2006 that asserted, with reference to a report compiled by NATO experts, that Russia, Iran, Libya, Qatar, Algeria, and the countries of Central Asia were considering creating a pricing cartel aimed at increasing their revenues by uniting the suppliers of natural gas to the EU and of liquefied natural gas to the global market.

The phrase was first uttered, however, in 2001 by representatives of Iran: during an interview with Kommersant on June 9, 2001, Iranian Ambassador to Russia Mahdi Safari talked openly about the idea as something that Iran was committed to realizing. For its part, Russia has always sworn off the idea. In a response to the article in the Financial Times, a senior representative of the Russian presidential administration huffed, "They [the EU] are simply not in a position to understand the idea of energy security advanced by Russia at the G8 summit in St. Petersburg."

Ayatollah Khamenei understood the idea of a "gas OPEC" in approximately the same terms as the NATO experts, but with one big difference: he embraced it wholeheartedly. "Our two countries can become mutually supportive partners in the spheres of politics, economics, and regional and international questions," said the ayatollah, emphasizing the political rather than the economic character of the idea. According to Khamenei, Iran and Russia together control "more than half" of the world's gas reserves (in fact, the figure is 42%), meaning that such a partnership makes perfect political sense.

From an economic point of view, a "gas OPEC" would be minimally beneficial for Russia's main gas exporter, Gazprom. At the present moment Iran supplies practically no gas to the countries of the European Union and to the EU's neighbors; the only country in the region currently receiving minimal supplies from Iran's gas network is Turkey. The majority of Gazprom's supply links with key countries in the EU, including Germany, France, and Italy, are through long-term contracts in which the price of the gas is pegged to the price of oil. Controlling gas prices through a pricing cartel would be effective only if the EU follows through on its threat to limit future long-term contracts.

That is exactly the kind of liberalization in the EU's energy market that Gazprom has come out strongly against, most recently last Friday, when Gazprom deputy managing director Alexander Medvedev called attacks on the existing system "impermissible." Creating a real gas cartel would be impossible without a shift in the pricing system in the EU market, and Mr. Medvedev explained that it will thus be impossible to organize a "gas OPEC" within the next 15-20 years. Yesterday Gazprom's press service confirmed that it knew nothing about plans to create a "gas OPEC."

Iran would also be anything but an uncomplicated partner for Gazprom. During the company's earlier participation in the development of the South Pars gas field, despite having invested heavily in extraction infrastructure, equipment, and technology, Gazprom was denied the access it desired to Iranian gas exports. Clearly, Gazprom still has hopes of gaining access to the export of Iranian energy resources by entering into a partnership with Iran, but for that to happen, Iran would have to amend its laws to give the Russian gas giant the access it has demanded to Iran's gas export market.

Moreover, Gazprom and Iran are potential competitors. Iran's potential as a supplier of gas to the EU will develop fully only after the construction of the Nabucco gas pipeline in 2012 – a project that competes with the Russian pipeline project in southern Europe. With regard to the CIS, all of the countries named in the list of those purported to be contemplating participation in a "gas OPEC" project are either potential or actual competitors for Russia in the US, the EU, and Southeast Asia.

However, no competition between Russia and Iran is expected in the gas market before 2012, and a "gas OPEC" could have excellent potential as a political alliance. The first countries that could be convinced to join such an alliance may be Algeria and Turkmenistan, especially since Iran is known to have its eye on Turkmenistan as a potential source of gas (the country currently supplies around 5 billion cubic meters of gas annually to Iran) and Russia buys up the remainder of Turkmenistan's gas.

In terms of gas supplies to the EU, it might be easier and more profitable for Russia to strike a deal with Algeria, since Gazprom supplies its crude oil to the countries of Eastern, Central, and Northern Europe, while Algeria sells its oil in Southern and Southwestern Europe. Thus, the two suppliers do not compete with each other directly.

In addition, yesterday Iran announced preliminary approval of a deal with the Spanish company YPF Repsol and Shell concerning a $10 billion project for developing the South Pars gas field. Under the terms of the agreement, liquefied natural gas will be supplied to terminals in Europe starting in 2015, which will mean competition for Russian, Norwegian, Libyan, Egyptian, and Algerian liquefied and pipeline gas.

In the political scheme of things, the Iranian ayatollah's bold announcement plays right into the hands of the Kremlin in its foreign policy scuffles with the EU. At the end of last year relations between Moscow and Brussels cooled noticeably, chiefly because Russia disagreed with many of the points in the European Energy Charter and Poland vetoed the start of talks concerning partnership agreements between Russia and the EU. Since the gas war between Russia and Belarus, the tension has become even more unbearable, and criticism has mounted from European politicians and analysts alarmed by the course Russia is charting in the energy sector. There is no doubt that Europe's attitude towards Russia on a wide range of topics will become even more cautious in the future. The possible liberalization of the EU's gas market has the potential to be used to exert pressure on Russia, in which case Russia could hit Europe back with the threat of a gas cartel as a warning not to step too far out of line in its struggle against the westward expansion of Russia's gas empire.

Though these are all long-term conjectures, today Igor Ivanov will meet with Bandar bin Sultan, the general secretary of the National Security Council of the real OPEC's leading member, Saudi Arabia. Currently, Saudi Arabia extracts practically no gas for export and does not produce liquefied natural gas, meaning that it too could be a candidate for membership in a "gas OPEC" in the next few years.

The Ten Top Players on the World Gas Market

From Left to Right: Country, Proven Reserves (trillions of cubic meters), Extraction (billions of cubic meters), Deliveries to the EU (billion of cubic meters)

In Switzerland the discussion clearly went nowhere, while during Mr. Ivanov's visit to Tehran, all it took was a few words from Iranian Supreme Leader Ayatollah Ali Khamenei to turn the occasion into a sensation. Commenting on the message sent to him by President Putin and the idea of partnership between Russia and Iran, the ayatollah unexpectedly initiated a discussion of creating a "gas OPEC." "Our two countries, in helping each other, can create an organization based on cooperation in the gas sphere, along the lines of OPEC," the Iranian state news service IRNA quoted Ayatollah Khamenei as saying.

IRNA did not report Mr. Ivanov's answer, and there is a reason for that. The idea of a "gas OPEC" is explicitly Russia's, but Russia consistently denies reports that the Kremlin has plans to create a cartel uniting the countries that supply gas to the EU. The most recent denial of the existence of plans for a "gas OPEC" came during Russian Minister of Industry and Energy Viktor Khristenko's visit to Algiers in January, when Algeria and Russia issued a joint statement saying that they see no point in organizing a gas pricing cartel.

The phrase "gas OPEC" entered the global political lexicon in the wake of a Financial Times article from November 13, 2006 that asserted, with reference to a report compiled by NATO experts, that Russia, Iran, Libya, Qatar, Algeria, and the countries of Central Asia were considering creating a pricing cartel aimed at increasing their revenues by uniting the suppliers of natural gas to the EU and of liquefied natural gas to the global market.

The phrase was first uttered, however, in 2001 by representatives of Iran: during an interview with Kommersant on June 9, 2001, Iranian Ambassador to Russia Mahdi Safari talked openly about the idea as something that Iran was committed to realizing. For its part, Russia has always sworn off the idea. In a response to the article in the Financial Times, a senior representative of the Russian presidential administration huffed, "They [the EU] are simply not in a position to understand the idea of energy security advanced by Russia at the G8 summit in St. Petersburg."

Ayatollah Khamenei understood the idea of a "gas OPEC" in approximately the same terms as the NATO experts, but with one big difference: he embraced it wholeheartedly. "Our two countries can become mutually supportive partners in the spheres of politics, economics, and regional and international questions," said the ayatollah, emphasizing the political rather than the economic character of the idea. According to Khamenei, Iran and Russia together control "more than half" of the world's gas reserves (in fact, the figure is 42%), meaning that such a partnership makes perfect political sense.

From an economic point of view, a "gas OPEC" would be minimally beneficial for Russia's main gas exporter, Gazprom. At the present moment Iran supplies practically no gas to the countries of the European Union and to the EU's neighbors; the only country in the region currently receiving minimal supplies from Iran's gas network is Turkey. The majority of Gazprom's supply links with key countries in the EU, including Germany, France, and Italy, are through long-term contracts in which the price of the gas is pegged to the price of oil. Controlling gas prices through a pricing cartel would be effective only if the EU follows through on its threat to limit future long-term contracts.

That is exactly the kind of liberalization in the EU's energy market that Gazprom has come out strongly against, most recently last Friday, when Gazprom deputy managing director Alexander Medvedev called attacks on the existing system "impermissible." Creating a real gas cartel would be impossible without a shift in the pricing system in the EU market, and Mr. Medvedev explained that it will thus be impossible to organize a "gas OPEC" within the next 15-20 years. Yesterday Gazprom's press service confirmed that it knew nothing about plans to create a "gas OPEC."

Iran would also be anything but an uncomplicated partner for Gazprom. During the company's earlier participation in the development of the South Pars gas field, despite having invested heavily in extraction infrastructure, equipment, and technology, Gazprom was denied the access it desired to Iranian gas exports. Clearly, Gazprom still has hopes of gaining access to the export of Iranian energy resources by entering into a partnership with Iran, but for that to happen, Iran would have to amend its laws to give the Russian gas giant the access it has demanded to Iran's gas export market.

Moreover, Gazprom and Iran are potential competitors. Iran's potential as a supplier of gas to the EU will develop fully only after the construction of the Nabucco gas pipeline in 2012 – a project that competes with the Russian pipeline project in southern Europe. With regard to the CIS, all of the countries named in the list of those purported to be contemplating participation in a "gas OPEC" project are either potential or actual competitors for Russia in the US, the EU, and Southeast Asia.

However, no competition between Russia and Iran is expected in the gas market before 2012, and a "gas OPEC" could have excellent potential as a political alliance. The first countries that could be convinced to join such an alliance may be Algeria and Turkmenistan, especially since Iran is known to have its eye on Turkmenistan as a potential source of gas (the country currently supplies around 5 billion cubic meters of gas annually to Iran) and Russia buys up the remainder of Turkmenistan's gas.

In terms of gas supplies to the EU, it might be easier and more profitable for Russia to strike a deal with Algeria, since Gazprom supplies its crude oil to the countries of Eastern, Central, and Northern Europe, while Algeria sells its oil in Southern and Southwestern Europe. Thus, the two suppliers do not compete with each other directly.

In addition, yesterday Iran announced preliminary approval of a deal with the Spanish company YPF Repsol and Shell concerning a $10 billion project for developing the South Pars gas field. Under the terms of the agreement, liquefied natural gas will be supplied to terminals in Europe starting in 2015, which will mean competition for Russian, Norwegian, Libyan, Egyptian, and Algerian liquefied and pipeline gas.

In the political scheme of things, the Iranian ayatollah's bold announcement plays right into the hands of the Kremlin in its foreign policy scuffles with the EU. At the end of last year relations between Moscow and Brussels cooled noticeably, chiefly because Russia disagreed with many of the points in the European Energy Charter and Poland vetoed the start of talks concerning partnership agreements between Russia and the EU. Since the gas war between Russia and Belarus, the tension has become even more unbearable, and criticism has mounted from European politicians and analysts alarmed by the course Russia is charting in the energy sector. There is no doubt that Europe's attitude towards Russia on a wide range of topics will become even more cautious in the future. The possible liberalization of the EU's gas market has the potential to be used to exert pressure on Russia, in which case Russia could hit Europe back with the threat of a gas cartel as a warning not to step too far out of line in its struggle against the westward expansion of Russia's gas empire.

Though these are all long-term conjectures, today Igor Ivanov will meet with Bandar bin Sultan, the general secretary of the National Security Council of the real OPEC's leading member, Saudi Arabia. Currently, Saudi Arabia extracts practically no gas for export and does not produce liquefied natural gas, meaning that it too could be a candidate for membership in a "gas OPEC" in the next few years.

The Ten Top Players on the World Gas Market

From Left to Right: Country, Proven Reserves (trillions of cubic meters), Extraction (billions of cubic meters), Deliveries to the EU (billion of cubic meters)

- Russia: 47.82, 598.0, 121.9

- Iran: 26.74, 87.0, 0

- Qatar: 25.78, 43.5, 4.56

- Saudi Arabia: 6.90, 69.5, 0

- United Arab Emirates: 6.04, 46.6, 0.31

- United States: 5.45, 525.7, 0

- Nigeria: 5.23, 21.8, 11.81

- Algeria: 4.58, 87.8, 55.8

- Venezuela: 4.32, 28.9, 0

- Iraq: 3.17, 1.75, 0

(2005 data from the BP Statistical Review of World Energy 2006)

No comments:

Post a Comment