Russia has moved to allay fears that it could cut vital oil flows to Europe despite heightened tensions over the country's aggressive stance towards its former client states. Russia's energy minister insisted that it was working to ensure stable oil supplies through the key Druzhba pipeline that links Russia to eastern Europe and the west.

Russia has moved to allay fears that it could cut vital oil flows to Europe despite heightened tensions over the country's aggressive stance towards its former client states. Russia's energy minister insisted that it was working to ensure stable oil supplies through the key Druzhba pipeline that links Russia to eastern Europe and the west."We are doing everything we can so Druzhba can keep working stably and supply European consumers with enough oil," Sergei Shmatko said during a visit to Tajikistan.

"We have worked for many years to gain not just the image, but the status of a reliable energy supplier to Europe and we would never let it suffer, even in this political situation." Officials at Lukoil also denied they had received political pressure to cut supplies next week.

Sources told The Daily Telegraph this week that the Kremlin has prepared Russian oil companies to cut supplies in the face of threatened economic sanctions from the European Union. Until yesterday, the EU had threatened to take a hard line towards Russia over its invasion of Georgia, but the comments from Russia coincided with those from French officials, whose country currently holds the rotating EU presidency, who appear to have since shied away from imposing any formal sanctions.

Yesterday, the Russian ambassador to the UK, Yury Fedotov, said he hoped “people will think twice before making such a decision because it would be quite dangerous, especially for the current economic situation”.

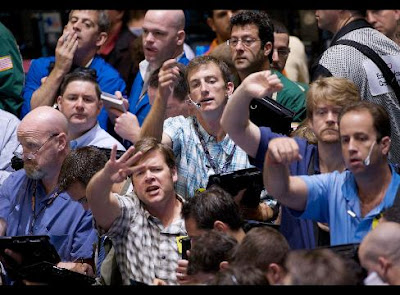

Energy markets have been nervously watching the dispute between Europe and Russia, the world's second-largest oil exporter and oil prices yesterday rose $2.23 to $117.82 a barrel. The possible threat of Tropical Storm Gustav becoming a hurricane and disrupting oil production in the Gulf of Mexico was also a factor in the rise. "Only a sick mind would think of cutting off Europe," a trader at a Russian oil company said.

"Technically it is practically impossible, since (Russian) refineries are running at maximum rates and it is difficult to arbitrage right now."

"You can't completely rule it out, though," the trader added. "Politics always interferes with work."

Although Russia claims it has never cut off oil supplies for political reasons - even during the height of the Cold War - analysts believe it has often done so in the past, albeit in different guises. Last month, Russia cut oil deliveries to the Czech Republic by 50pc citing technical issues that reduced the availability of crude. However it came as the Czech government approved plans to host a US radar that is part of its missile shield defence system, prompting accusations that the cutbacks were politically motivated. Russia was accused of playing a similar game with Ukraine and the Baltic states last winter, ostensibly hiking prices for economic reasons that many suspected were politically motivated as those countries moved further away from the Russian sphere of influence.

Source: The Telegraph| By David Litterick

Blogalaxia:Actualidad fotolog Technorati:UPDATE Bitacoras:HidrocarburosagregaX:Diario

![[MEXICO] Looming Energy Crisis In Mexico Stirs Debate](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjkRfGacna58UD2NvLkCO9S5epBzochrzkXT6hGQHyvB41mgnZq6jucQ9ACvUs1Ex02K0eYrHsX7KRlCCtMgjo8_Cq0RzyxkHS_d04BDDttRmuWYm-85NFTY2tx-IVWH8DEK3fFeg/s400/calderon_PEMEX.jpg)