Iran has $8 billion in its Oil Stabilisation Fund (OSF), which forms part of the country's foreign reserves, the central bank's website quoted Governor Tahmasb Mazaheri as saying.

Mazaheri said that on October 31 Iran had $9.56bn in the fund, but it was not immediately clear if the two figures were directly comparable.

When calculating its holdings based on cash coming in and out of the fund, "the amount of money held in the OSF is $8bn," Mazaheri said, without specifying if this was a different method in estimating the fund's assets.

The fund was set up several years ago to save windfall oil earnings at times like now when crude prices have surged to record levels, so that the extra cash could be use in times of need if prices tumbled or to finance investment projects.

Some lawmakers have accused the government of the world's fourth largest oil producer of dipping into the fund to finance current spending even now and have complained that the fund's value should have risen faster given climbing revenues.

Mazaheri said that on October 31 Iran had $9.56bn in the fund, but it was not immediately clear if the two figures were directly comparable.

When calculating its holdings based on cash coming in and out of the fund, "the amount of money held in the OSF is $8bn," Mazaheri said, without specifying if this was a different method in estimating the fund's assets.

The fund was set up several years ago to save windfall oil earnings at times like now when crude prices have surged to record levels, so that the extra cash could be use in times of need if prices tumbled or to finance investment projects.

Some lawmakers have accused the government of the world's fourth largest oil producer of dipping into the fund to finance current spending even now and have complained that the fund's value should have risen faster given climbing revenues.

READ MORE...

The central bank previously reported it had $9.469bn at the close of the last Iranian year, which ended on March 20. Iran does not release figures for total foreign reserves.

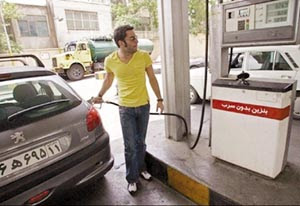

Tehran is striving to reduce the costly petrol imports, mainly by rationing. It also subsidises all fuel sold at the pumps.

The introduction of rationing helped reduce import volumes of the fuel to about 315,000 tonnes of petrol for October and November, or 88,000 barrels per day. That is about a 60 per cent cut from the pre-rationing level of 770,000 tonnes.

An Iranian oil official said in October that Iran was aiming to earn about $70bn in oil export revenues by March, after making about $35bn in the first half of the year.

The central bank has said it is diversifying its reserves away from US dollars, in response to US sanctions imposed on Iranian financial institutions as part of Washington's bid to pressure Iran over its nuclear ambitions.

Tehran is striving to reduce the costly petrol imports, mainly by rationing. It also subsidises all fuel sold at the pumps.

The introduction of rationing helped reduce import volumes of the fuel to about 315,000 tonnes of petrol for October and November, or 88,000 barrels per day. That is about a 60 per cent cut from the pre-rationing level of 770,000 tonnes.

An Iranian oil official said in October that Iran was aiming to earn about $70bn in oil export revenues by March, after making about $35bn in the first half of the year.

The central bank has said it is diversifying its reserves away from US dollars, in response to US sanctions imposed on Iranian financial institutions as part of Washington's bid to pressure Iran over its nuclear ambitions.

Via: Gulf Daily News

No comments:

Post a Comment