Crude oil rose for the first time in three days in New York as a storm near Cuba prompted evacuations from rigs and production platforms in the Gulf of Mexico.

Crude oil rose for the first time in three days in New York as a storm near Cuba prompted evacuations from rigs and production platforms in the Gulf of Mexico.Tropical Storm Fay, with maximum sustained winds of about 50 miles (80 kilometers) an hour, was centered 200 miles southeast of Havana, Cuba at 8 p.m. New York time and may strengthen to a hurricane before striking Florida's northwestern coast Aug. 19, the National Hurricane Center said. Gains were limited on speculation slowing U.S. economic growth will trim fuel demand.

``We would have to see oil prices spike'' if Fay veers west toward Louisiana, Peter Beutel, president of energy consultant Cameron Hanover Inc. in New Canaan, Connecticut, said in an interview with Bloomberg Television. ``But I don't think they'll be able to hold on to any spike, particularly if damage is minimal.''

Crude oil for September delivery rose as much as 98 cents, or 0.9 percent, to $114.75 a barrel on the New York Mercantile Exchange and was trading at $114.73 at 8:35 a.m. in Singapore. The contract earlier fell as low as $113.25.

Brent crude for October settlement rose as much as 63 cents, or 0.6 percent, to $113.18 a barrel on London's ICE Futures Europe exchange at the same time.

The northern Gulf of Mexico accounts for more than a fifth of U.S. oil production.

Storms routinely disrupt tanker traffic and production in the region in the North Atlantic hurricane season running June through November. In 2005, Hurricane Katrina wrecked platforms and refineries around New Orleans, prompting an international release of fuel from reserve stockpiles.

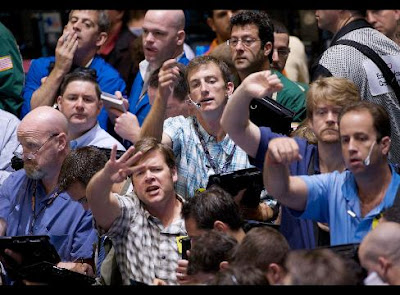

Gulf Evacuations

Royal Dutch Shell Plc evacuated about 360 non-essential staff from the eastern Gulf the past two days. Production hasn't been affected. Transocean Inc., the world's largest offshore oil driller, said it evacuated 130 workers and suspended operations at several rigs in the Gulf as a precaution because of the storm.

New York oil futures fell 1.1 percent to settle at $113.77 on Aug. 15. Earlier in the session it touched $111.34, a 15-week- low, as the dollar rose for a fifth week against the euro and the Organization of Petroleum Exporting Countries warned of risks to world demand from the slowing global economy.

A report tomorrow will probably show home building in the U.S., the world's largest oil consumer, fell to the lowest pace in 17 years in July amid rising borrowing costs and record foreclosures.

Sentiment has turned bearish and oil's direction is being driven by the dollar, Beutel said. A weak housing report will reinforce investor expectations of slowing demand, while a strong number may bring forward the prospect of a rate-rise by the Federal Reserve, further supporting the dollar, Beutel said.

The dollar rose 2.2 percent against the euro last week. It was at $1.4717 in early Asian trading, from $1.4687 late in New York last week.

Source: Bloomberg| By Gavin Evans

Blogalaxia:Actualidad fotolog Technorati:UPDATE Bitacoras:HidrocarburosagregaX:Diario

No comments:

Post a Comment